His expertise spans various industries, consistently providing accurate insights and recommendations to support informed decision-making. Rick simplifies complex financial concepts into actionable plans, fostering collaboration between finance and other departments. With a proven track record, Rick is a leading writer who brings clarity and directness to finance https://www.personal-accounting.org/ and accounting, helping businesses confidently achieve their goals. A streamlined accounts receivable process and an enhanced customer experience that fosters long-term relationships. Automation allows for the instant generation and dispatch of invoices as soon as an order is confirmed via their preferred method—be it email, EDI, or even traditional mail.

How to measure performance of AR management

Now that we have cleared that up, follow these 8 tips to improve your receivables management and make payment collection effortless and efficient. Businesses can focus on improving their approach to accounts receivable (AR) management, and in the process unlock more cash, reduce operational costs, and improve overall efficiency. Often the root cause of your collections and cash flow issues is simply a matter of poor internal processes. One of the easiest ways to mitigate the constant issues is to make sure that each of the teams understands the end objective of the other.

Improved billing & invoicing

This lets them save and comment on invoices, save their payment information, invite others to access the account and collaborate on projects they’ve been invited to view. Most accounting software goes beyond these tasks with additional built-in modules for invoicing and billing as well as inventory management, among other functions. The more your accounting software becomes a one-stop shop for these financial chores, the fewer integrations you need to consider. Once credit terms are established, they can be changed based on both marketing strategies and financial management goals. For example, discounts for early payments can be more generous, or the full credit period can be extended to stimulate additional sales.

Accounts Receivable Management

In this case, the company would record a debit to accounts receivable for $5,000 and a credit to the revenue account for the same amount. When the client pays the invoice in 30 days, the company records a debit to the cash account for $5,000 and a credit to the accounts receivable account, reducing the receivable balance to zero. The Accounts Receivable process often involves a range of manual tasks, those manual actions both create costs and decrease collector effectiveness. By automating more of the AR process and thus reducing manual effort, companies can improve collector effectiveness and accelerate collections. These reasons are that it’s time-consuming, it’s a complex and tedious process that businesses don’t want to handle it.

Remember that even if you outsource your AR management someone from your business will always have to get involved. AR management can be a tedious process but it’s not something that you will completely be able to outsource. Accounts payable optimization is often the first target for businesses seeking a stronger working capital position, but it’s not the only option available. Accounts receivable optimization is another opportunity that’s well worth pursuing. In competitive markets or challenging economic conditions, businesses benefit from optimizing for working capital.

- We’ve also put together a list of the 6 best tips for improving your accounts receivable.

- Accounts receivable is any amount of money owed by customers for purchases made on credit.

- The best accounting software makes it easy to keep a detailed financial record so that you’re ready come tax season.

NerdWallet independently reviews accounting software products before determining our top picks. We collect the data for our software ratings from products’ public-facing websites and from company representatives. Information is gathered on a regular basis and reviewed by our editorial team for consistency and accuracy. In our review of more than a dozen accounting software products, NerdWallet determined a couple of products are strong contenders that may be worth consideration for certain businesses. Consider one of the following solutions if those on our list above don’t suit your small-business accounting needs. If you don’t want to manually enter transactions into Wave, you can opt for the Pro plan to link an unlimited number of bank and credit card accounts for automated reconciliation.

If you only react after the payment is missed, you could be leaving money on the table in that accounting cycle. With the right processes and technology however, companies can accelerate customer payments by more intelligently https://www.quick-bookkeeping.net/break-even-point-calculator-bep-calculator-online/ targeting dunning. Often, a business offers this credit to frequent or special customers who receive periodic invoices. This allows customers to avoid having to make payments as each transaction occurs.

Secondly, pay attention to the tone of your communication when sending invoices. Maintain a clear, concise, and polite approach in both the invoice content and accompanying email communication. The lack best accounting software for rental properties of 2021 of a mechanism for utilizing empirical data hinders the ability to forecast potential adverse consequences. By reducing manual labor and errors, automation can result in significant cost savings.

Other business routinely offers all their clients the ability to pay after receiving the service. An electricity company is an example of a company with accounts receivable. They provide electricity to a space and wait for payment from their customers.

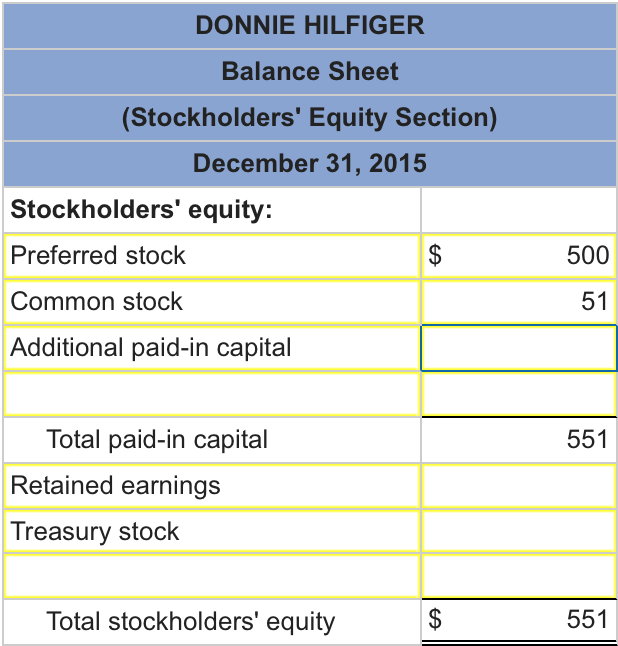

Under the accrual basis of accounting, the account is offset by an allowance for doubtful accounts, since there a possibility that some receivables will never be collected. This allowance is estimate of the total amount of bad debts related to the receivable asset. The amount of money owed to a business from their customer for a good or services provided is accounts receivable.

Establish clear payment terms, such as due dates, grace periods, and late fees, and clearly communicate these terms to customers. Develop a standard invoicing process with templates and numbering conventions for consistent, accurate billing. Generating and delivering invoices quickly is a key driver to getting paid faster. Companies that still manage invoices manually are inhibiting their AR process and should implement automated invoicing as quickly as possible. The collection effectiveness index (CEI) calculates the percentage of receivables a company collects during a given period.

By offering a range of payment options, you enhance convenience for your customers, eliminating the need for them to disrupt their daily routines to fulfill payment obligations. Accounts receivable represents money owed to a business for goods or services sold. Accounts payable is money a business owes to suppliers for goods or services purchased.

When a business provides a product or service and allows the customer to pay later, the amount that the customer owes is recorded as accounts receivable. The primary goal of accounts receivable management is to ensure the timely collection of payments owed by customers for goods or services provided on credit. Accounts receivable refers to the money that a business has a right to collect from its customers for goods or services provided. When a company sells something but has not yet received payment, the amount due becomes part of accounts receivable. These receivables function as a short-term asset on a company’s balance sheet, often appearing as an IOU from clients or customers.

For example, if a credit sale was made on June 1 and is still unpaid on July 15, that receivable is 45 days old. Aging of accounts is thought to be a useful tool because of the idea that the longer the time owed, the greater the possibility that individual accounts receivable will prove to be uncollectible. If a company has a prior relationship with a customer seeking trade credit, the customer’s payment history with the firm is also carefully evaluated before additional credit is granted. AR management faces many challenges that can slow and undermine its effectiveness. Poor communications between the business and customers can impact the business’s ability to follow through on payments due.

Whether a business is looking for faster billing, stronger compliance or more insightful analytics, automation serves as an effective solution for managing accounts receivable complexities. The balance of money due to a business for goods or services provided or used but not yet paid for by customers is known as Accounts Receivable. These are goods and services delivered by a business on credit to their customer with an understanding that payment will come at a later date.